Advanced Algorithmic CFD Trading: Building and Testing Strategies for UK Markets

19 October 2023

Algorithmic trading has revolutionised the way financial markets operate. It allows traders to execute trades at speeds and frequencies that were once unimaginable. Contract for Difference (CFD) trading is a popular choice for many traders in the UK market due to its flexibility and leverage. This article delves into advanced algorithmic CFD trading strategies tailored for the UK market, providing traders with insights on building, testing, and optimising their algorithms.

Building a robust trading algorithm

The foundation of successful algorithmic CFD trading lies in developing a robust trading algorithm. This process involves defining entry and exit criteria, risk management parameters, and position sizing rules. Traders must carefully consider the underlying assets they intend to trade and the time frames and indicators that will guide their algorithm.

For instance, a trader building an algorithm for trading CFDs on UK equities may focus on technical indicators such as moving averages, relative strength, or volatility measures. Additionally, they may incorporate fundamental data, such as earnings reports or economic indicators, to further refine their strategy. By meticulously designing a trading algorithm, traders set the stage for executing precise and well-informed trades.

Incorporating risk management protocols

Effective risk management is paramount in algorithmic CFD trading. Traders must implement protocols to protect their capital from significant losses. This includes setting stop-loss levels, position sizing limits, and leveraging appropriate risk-reward ratios. Traders must also be vigilant in monitoring and adjusting these parameters as market conditions evolve.

For example, a trader might implement a dynamic position sizing algorithm that adjusts trade sizes based on recent volatility. The algorithm may recommend more minor positions to limit potential losses in increased market turbulence. In more stable market conditions, the algorithm may allow larger position sizes to capitalise on opportunities. By embedding robust risk management protocols into their algorithms, traders can mitigate potential losses and protect their capital.

Utilising technical indicators for precision

Technical indicators play a crucial role in algorithmic CFD trading. They provide quantifiable data points that can inform trading decisions. Traders may choose from various indicators, including moving averages, oscillators like the Relative Strength Index (RSI), or trend-following tools like the Moving Average Convergence Divergence (MACD).

For instance, a trader building an algorithm for trading CFDs on commodities in the UK market might rely on indicators like the Commodity Channel Index (CCI) to identify potential overbought or oversold conditions. By incorporating technical indicators, traders can enhance the precision of their algorithms and make more informed trading decisions.

Backtesting for robustness and effectiveness

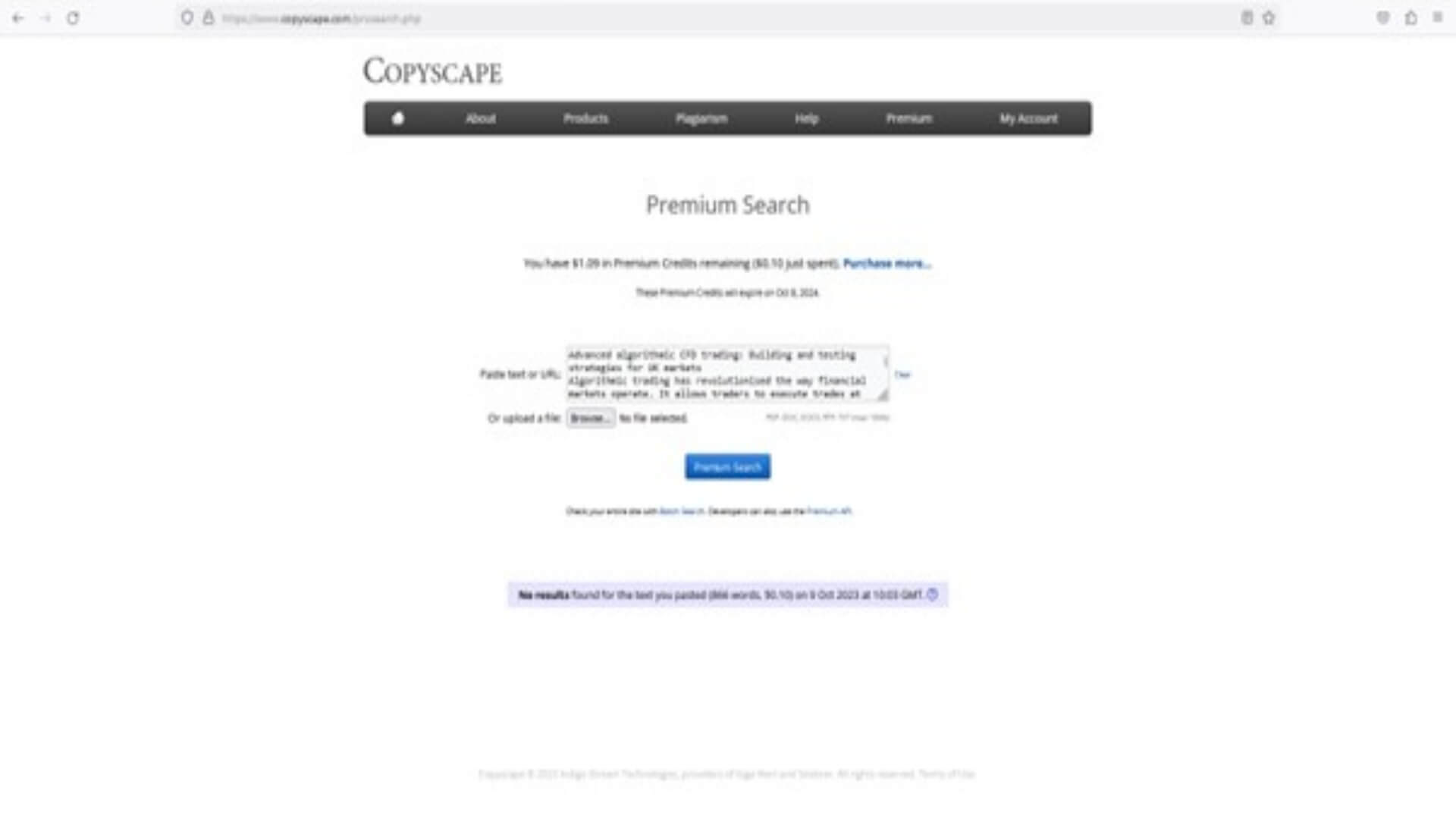

Backtesting is a critical step in the development of any algorithmic trading strategy. It involves applying historical data to the algorithm to evaluate its performance under past market conditions. Traders can assess the algorithm’s profitability, risk-adjusted returns, and drawdowns. This process allows traders to identify any weaknesses or areas for improvement.

For example, a trader may conduct extensive backtesting on their CFD trading algorithm using historical UK market data to ensure its effectiveness across various market conditions. Additionally, traders should be mindful of potential overfitting, where the algorithm is excessively tuned to historical data, potentially leading to poor performance in real-world situations. By rigorously backtesting their algorithms, traders can gain confidence in their strategies’ robustness and effectiveness.

Live testing and optimization in real-time

Once an algorithm has demonstrated effectiveness through backtesting, conducting live testing in real-time market conditions is crucial. This phase allows traders to validate the algorithm’s performance dynamically. Traders should closely monitor the algorithm’s execution, making adjustments as necessary to ensure it operates as intended.

During live testing, traders may uncover nuances or unexpected behaviours in their algorithms. This iterative testing and optimisation process is essential for refining and fine-tuning the algorithm for optimal performance in the UK CFD market. Traders must approach live testing with a disciplined and cautious mindset, as real-time execution may reveal aspects of the algorithm that were not apparent in backtesting.

Liquidity considerations in algorithmic CFD trading

Liquidity is a crucial factor in algorithmic CFD trading. In the UK market, different assets may exhibit varying levels of liquidity, which can impact the execution of trades. Illiquid assets may have wider spreads and potentially encounter challenges executing large orders. Traders must carefully consider liquidity when selecting holdings for their algorithmic trading strategies.

Traders should also be mindful of the time of day when executing trades, as liquidity can fluctuate. For instance, liquidity tends to be higher during market opening hours or significant economic announcements. This can be a consideration for traders who aim to execute their strategies precisely. By factoring in liquidity considerations, traders can optimise their algorithmic trading strategies for the UK CFD market.

On that note

Advanced algorithmic CFD trading in the UK requires a comprehensive and meticulous approach. Building a robust trading algorithm, incorporating risk management protocols, utilising technical indicators, backtesting, and live testing and optimization are all integral steps. By following these strategies, traders can enhance their likelihood of success in algorithmic CFD trading. Remember, trading involves risk, and there are no guarantees of profit. A disciplined and well-informed approach is crucial for long-term success in the financial markets.

Technology

25 March 2025

Ransomware-As-A-Service Variants on the Rise With Critical Infrastructure Providers at the Greatest Risk

Business Advice

25 March 2025

Claims Processing Automation: How Insurers Can Cut Costs and Improve CX

Technology

18 March 2025

Secret Signs Your Internet Security Has Been Compromised